What documents/information do I need to lease a car? No Credit Check Car Lease

Pay bills on time and set up automatic payments wherever possible. Set up payment plans with creditors if necessary. Limit applying for new credit, as doing so requires a hard credit check, which.

No Credit Check Car Finance Carplus

Secondary car insurance can provide some benefits, but there are some limitations, especially if you have a primary auto. April 25, 2024 • 3 min read. How Do I Check My Credit Card Benefits? Understanding your credit card benefits can help you get more value from your credit card. You can find a. April 25, 2024 • 5 min read.

Car Rental No Credit Check Uk Jarmite Car Rentals Home Facebook The car rental express

Yes. Unfortunately, the credit score is one of the important criteria for leasing a car. If you are to lease a car, then you need a credit score of at least 700. In other words, the lease company will check if the applicant is financially stable enough to lease the car and, most importantly, make the payments regularly.

Can I Lease A Car At 19

To increase the chances that this approach will work, the co-signer should have a minimum credit score of 670 or better, says Sexton. Keep in mind that skipping payments can cause trouble for your.

Barksdale Federal Credit Union Near Me No Credit Check Auto Lease

According to NerdWallet, the exact credit score you need to lease a car varies from dealership to dealership. The typical minimum for most dealerships is 620. A score between 620 and 679 is near.

No Credit Check Car Loans Nz / No Credit Check Car Lots, Loans & Dealers Near You Provide

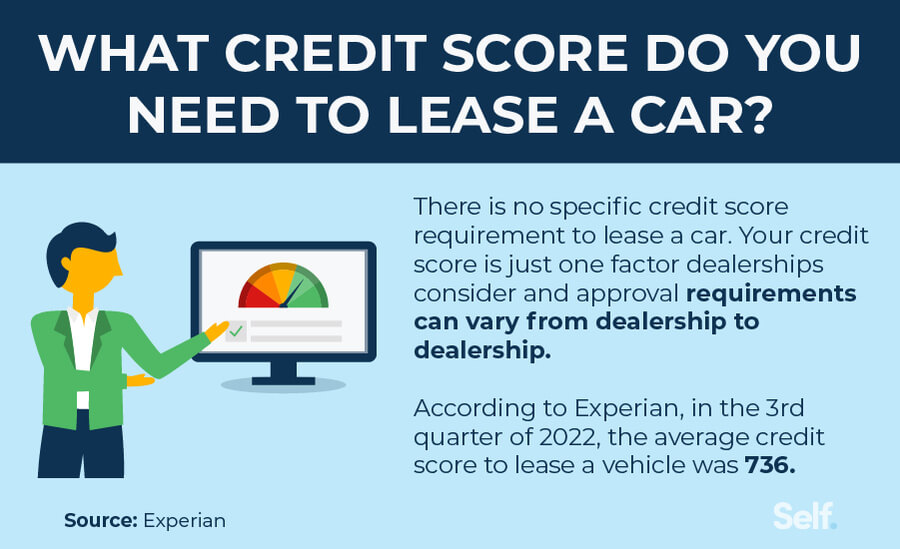

When you lease a car, your credit score plays a role in the type of vehicle you can get as well as how much you'll pay. According to Experian data, the average credit score for a car lease in the second quarter (Q2) of 2020 was 729, putting it right in the middle of the "prime" borrower category—those with credit scores of 661 to 780.. While a prime credit score gives you a big advantage.

No Credit Check Car Loans How they work YouTube

A car lease is a great way to drive a new vehicle without paying for a car upfront. However, having no credit can hinder your ability to lease a car. The good news is that there are a few ways around having no credit history if you really want to get your hands on a new vehicle to lease. Keep reading for more information about leasing a vehicle.

Thinking About a Car Lease Payoff Know the Pros and Cons

If the lease agreement requires that you pay $10,000 over a five-year period -- 60 months -- for example, your monthly payments would be $166, not including any taxes or other fees. With a 4-percent interest rate, you would only have to pay an additional $6 per month. With a 14-percent interest rate, however, you would have to pay an additional.

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

When you lease a car, showing your credit score helps to establish trust between you and the dealer. If you don't have a credit score or your numbers aren't that great, showing alternative documents may be helpful or even necessary. Documents that can demonstrate your worthiness of a lease include: Work history. Bills paid on time.

No Credit Check Car Lease? Non Status Car Leases

The average credit scores for those who got a lease at the in the first quarter of 2023 were 736, compared to 742 for new car financing and 677 for used car financing, according to the Experian State of the Automotive Finance Market report. When you lease, you're paying for the car's expected depreciation during the lease term, along with a.

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

3. Take over another lease. Taking over an existing lease is one final way to get a lease with no credit. Instead of going through the leasing company directly, you approach a leaseholder about.

Car Lease Credit Check Do You Need One To Lease A Car? Lease Fetcher

Generally, leasing providers look for credit scores of 700 or over on the FICO scale when it comes to assessing applications. FICO use a rating between 300 and 850 and require a score of 670 or over to be deemed as having "good" credit. Having a credit score below 700 on the FICO scale, can make getting finance difficult.

SMARTPAY PHONE LEASE, NO CREDIT CHECK FINANCING YouTube

You can get the lease from someone you know or use a website to find drivers looking to transfer their leases to someone else. However, you still need to get your credit approved if you pursue.

Do They Check Your Credit When You Lease A Car Car Retro

We rented a car yesterday with Chilean Rent A Car. We got the cheapest car for 24 hours. I added the extra insurance that waives the deductible and the GPS. The total cost was CLP$27,900. We drove from Santiago to Portillo. We then drove to Valpairaiso via a scenic route and back to Santiago. We drove a total of 520km.

Car Dealerships In Maryland No Credit Check Bad Credit Car Finance No Credit Check Puts Your

Customers leasing a new car in the fourth quarter of 2024 had an average credit score of 737. You'll find the best options above 700, but there's still hope for lower scores.

Finance Low Earnings

No more complicated car loans, interest rates, juggling car payments, thinking about your credit score and credit checks, lease payments, or lease options. Unlike traditional leasing, car subscriptions don't require long-term contracts or large down payments, allowing you to remain flexible and use the car as needed without committing long-term.

.